Iger’s Song and Dance Numbers

The day after Bob Iger’s November 8th earnings call Disney’s stock price jumped up $6 per share.

Which immediately raises the question, did Disney have that good of a quarter?

Oh hell no, but there were some numbers that could be tortured until they confessed. Plus, the actors’ strike ended yesterday and that had a positive halo effect on the whole industry.

If you take Iger’s presentation at face value then I suppose it does look like it’s all sunshine and furry kittens at The Walt Disney Company. Which is easy to do when you have the most patient investors on Earth. Certainly, the institutional investors were serving up the kind of softballs you only see at a Joe Biden press conference. I’m surprised no one asked Iger what his favorite flavor of ice cream is, the questions were that unchallenging.

He talked about all of the money that Disney-owned films made this year. Or to be exact Disney had the “top 4 biggest grossing pictures in the past year.” Well, this is technically true, and if the budgets hadn’t been insane they might have actually turned a profit but as it is Disney has probably lost better than $1 billion in theatrical releases since Wakanda Forever. And that is before The Marvels goes off in the wire tomorrow. Bob didn’t mention that.

One little interesting admission (kinda sorta) Bob said that there was a floor price for Hulu that was public knowledge and that Disney would be cutting them a check for that soon. Translation from Business Bullshitese: The press release we made last week about only paying $8 billion and change had absolutely no basis in reality. We will have to pay the actual floor price and then some but we sure as hell aren’t saying what that price really is now.

I was more than a little curious as to why Hugh Johnston had been brought in from Pepsi to be Disney’s new chief financial officer. I now know why. Johnson successfully fought off Nelson Peltz not too long ago. That was why he got hired.

Rather than admit that the parks are having trouble, Iger doubled down on the whole “We are investing $60 billion into the parks over the next ten years.” Except that (a) it’s all going into hotels and cruise ships (b) it’s mostly going to China (c) it’s backloaded to primarily kick in when it gets near the end of that ten-year mark and (c prime) Disney doesn’t have to actually follow through on it anyway.

There were some factually accurate positives. The addition to Disney+ of an ad-based tier is reportedly going smoothly and I actually believe that one. Unlike Netflix or Warner Brothers, Disney already had a system for that setup and running with Hulu. Expanding it was probably not a significant challenge.

None of that explains the jump in the share value.

Primarily, the stock price seems to have gone up on the basis of Wallstreet being retarded about subscription numbers again.

Iger pointed out that Disney+ has grown by 7 million subscribers this quarter and that is entirely due to “great content” like Guardians of the Galaxy 3, Elemental, and the live-action Little Mermaid.

Uh-huh…

Okay my Darklings, raise your hand if you are a subscriber to Charter but NOT a subscriber to Disney +.

All of you put your hands down. If you are a Charter subscriber you ARE indeed a subscriber to Disney+ because of the deal that Disney just made with Charter. I strongly suspect this accounts for all seven million new subs and then some. Admittedly, Disney was basically giving D+ away for free for the past month so that probably helped too.

The part that kind of shocked me was that none of the institutional investors asked about Disney restoring its stock dividends. The reason Disney was a grandma stock was because of that dividend. It was discontinued during Covid. Fine, granted it had to be done. However, Disney had agreed to restore the dividend by the end of the 4th quarter of fiscal year 23, which was this quarter. It didn’t happen and I can’t believe it didn’t get brought up.

The biggest news so far was that Bob Iger admitted he hadn’t spoken to Nelson Peltz. Since they are not meeting or taking phone calls this proxy fight WILL BE adversarial. I appear to have been wrong, Peltz won’t be invited to take a board seat. Iger is going to try to shut him out completely.

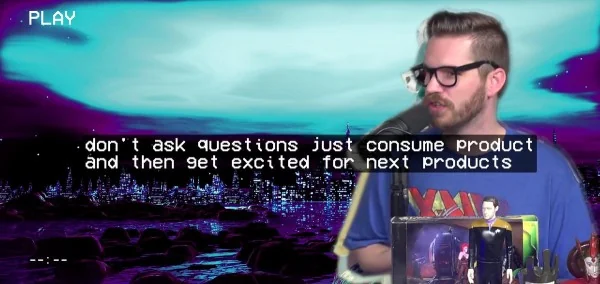

To sum up, Iger seems to have taken a lesson from Marvel’s marketing department.

“Sure, we had a shitty quarter but big things are coming. I promise!”

Given how indolent if not actually somnolent the institutional investors are being about Disney’s performance, I can only surmise it’s Boomer decision-making at the top. They remember what Disney used to be and what it used to mean to them when they were kids and they feel sentimental enough about these memories to try and protect Iger despite his performance failures.

Not that he’s asking my opinion but if he was, I would say that Nelson Peltz needs to launch the kind of “Save Disney” campaign that Roy Disney launched when he ousted Michael Eisner, if he’s going to move those torpid investors.